Switch your mortgage rate and lower your monthly mortgage payments

If you are an existing borrower you have a few options to keep your mortgage interest rate from creeping into a SVR (standard variable rate). The is SVR is of course almost always a higher interest rate. Let’s talk you through the options that wont cost a you a penny.

Option 1 – Remortgage to a DIFFERENT lender

This is the most common method of securing a competitive interest rate.

The pro’s for Remortgaging include,

- Could secure a new and better interest rate

- Your new lender may well offer a more flexible product

- You can change mortgage terms, such as borrow more money, change the term etc

The con’s for Remortgaging include,

- You will have submit a complete new mortgage application

- You may need to pay for new valuation, solicitor and arrangement fees

- You will need to provide full proofs

- Remortgaging on average takes between 4-8 weeks

Option 2 – Switch your mortgage with your existing lender

The pro’s for switching your mortgage include,

- Could secure a new and better interest rate

- No proofs generally required

- Can start savings almost immediately from your new rate

- Can switch if your circumstances have changed (poor credit, change job etc)

The con’s for switching your mortgage include,

- You will have to stay with the same lender

- Choice of products can be limited

Who is this site for ?

We want to help borrowers who are coming to the end of a fixed mortgage period or are currently in a lenders Standard Variable Rate. This can be up to 3 months in advance of a mortgage deal coming to an end. If your deal ends you will be paying a lenders SVR (standard variable rate) and your monthly mortgage costs can increase significantly.

If you fall into the following categories read on, we can help with our product switch/transfer service for FREE

- You are currently paying a Standard Variable (SVR) rate with your lender

- You are looking to bring to bring down your monthly mortgage costs

- Your circumstances have changed since you took out your mortgage (lost your job, have credit issues, change of family circumstance, changed your job, made changes to your property)

- You do not want to pay any mortgage adviser fees

The Process

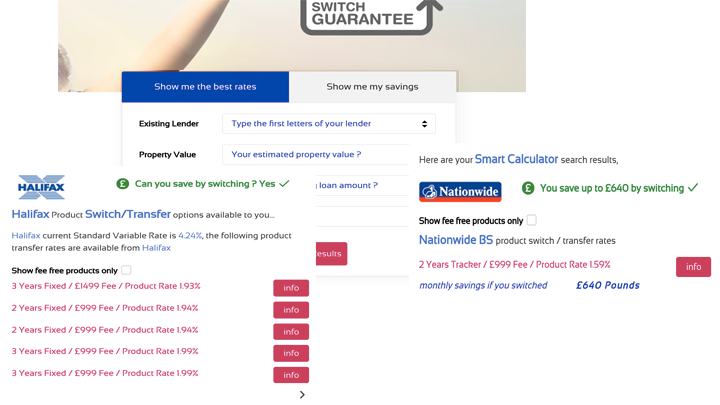

Use our online calculator to compare the rates available from your mortgage lender.